Microfinance & Overindebtedness

The microfinance crises in Bolivia and Andra Pradesh (India) among others, which have been characterized by overindebted borrowers and soaring delinquency rates, have revealed the potential downside risks of microfinance. Research on overindebtedness among microcredit clients is scant, however, and important research questions remain: How best to measure overindebtedness? What is the extent of the problem? Which behavioural characteristics or loan features are associated with the risk of overindebtedness? What policies could address the problem?

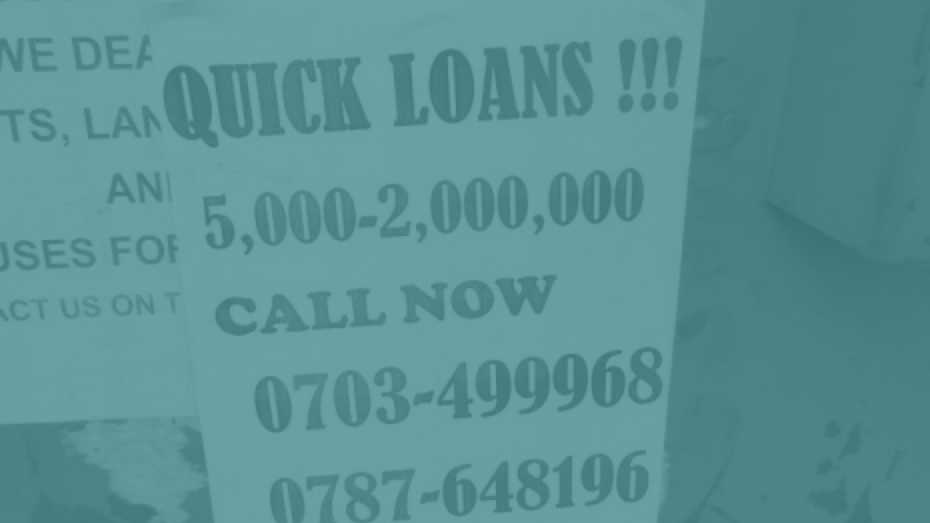

In a collaborative project together with the German Development Bank (KfW Entwicklungsbank), this research investigates overindebtedness at the household level, drawing on (a) primary household survey data collected in urban Uganda and (b) repayment data from a Ugandan microfinance institution. Supply-side (delinquency showing up in a bank’s balance sheets) and demand-side (debt-income ratio’s and more subjective indicators of customer distress events) measures appear to be only moderately correlated.

Researchers: Isabel Günther

Publications

Download Microcredit, financial literacy and household financial distress (PDF, 446 KB), 2017

Download Financial Distress in Microcredit Borrowers: Overindebtedness or a Symptom of Poverty? (PDF, 418 KB), February 2017

Download Do financial diaries affect financial outcomes? Evidence from a randomized experiment in Uganda (PDF, 14.8 MB), February 2017

Download Financial Struggling in Uganda: Who struggles more and why? (PDF, 377 KB), KfW Evaluation Update No. 2, December 2014